Disclosure concerning our editorial content standards. Getting married involves a fantastic event– and a great deal of logistical concerns. How do you submit joint taxes? Where do you go to change your name? Does marriage impact your credit score?

Regardless of your current credit rating, you may be questioning what will occur to your score after you get married.

Here's the short answer: marital relationship does not have any direct effect on your credit history. That stated, getting wed could assist you raise your rating in some scenarios, but it could test your creditworthiness in other ways.

Read on to learn more about the relationship in between marital relationship and credit scores, including information about how saying “I do” will impact your credit and suggestions for managing credit as a married couple.

What occurs to your credit rating after marital relationship?

Getting wed does not have any instant result on your credit. There's a simple factor for this: there are no joint credit reports or joint credit report, and marital status is not one of the aspects the 3 credit bureaus use to identify your credit history.

Furthermore, if you choose to change your name after marriage, the credit bureaus will report this change on your existing report, and your old name will stay noted as well.

Many people wonder if their spouse's credit– whether poor or great– will affect their own score. Instantly after marriage, your spouse's rating will not impact yours. Nevertheless, depending upon how you pick to manage your credit as a couple, your score could indirectly be impacted by your partner.

How does your partner's credit impact your rating?

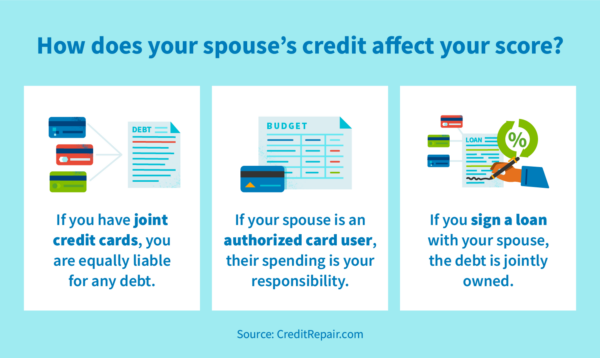

Given that your spouse is not listed on your credit report, they won't straight affect your credit score. However, your partner's credit routines could ultimately affect your rating– especially if you choose to have joint credit accounts or be licensed charge card users.

Here are a few of the manner ins which your spouse might indirectly affect your rating: Joint charge card: You and your partner are equally accountable for debt on a joint credit card, so the usage will be reported on your credit report. Licensed card user: If you grant your spouse licensed user status on your cards, you are ultimately accountable for any spending, so the complete balance will appear on your credit report.Cosigned loans: If you and your partner sign a loan together, the debt is collectively owned, so if they fail to pay, negative products will also appear on your credit report. Because numerous couples select to join their finances together after marital relationship, it is necessary to talk about how costs and financial obligation will be dealt with. Despite the fact that your partner's credit report does not straight influence your credit history, their credit habits can affect your rating if you combine any charge card or loans. What should you do if your spouse has poor credit? If your partner has bad credit, you'll have a number of decisions to make as you browse your financial lives together. Apply solo for loans and charge card: If you have a higher credit score, you may pick to make an application for loans or charge card separately to secure a much better interest rate.Aim to deal with financial obligation

: If your partner has financial obligation from before your marriage that

has actually impacted their credit history, you'll have to decide how to tackle it. Whether or not you are accountable

- for the financial obligation might differ according to your state's laws, so speak with a legal representative if necessary.Look to boost your spouse's credit report: With a favorable credit history

- , you might have the ability to supply a boost to your partner's credit score by adding them as a licensed user on your credit card. Eventually, your partner's poor credit is likely an opportunity for growth instead of a considerable obstacle. Couples can continue to request credit independently,

- so you can delight in the benefits of your high credit rating as you interact to enhance your partner's score. If you do pick to join charge account with your partner, they

may see an increase in their score from your strong credit rating– provided that they continue to practice excellent monetary habits. Should you join your credit accounts with your spouse's? Selecting to join charge account with your spouse is an individual choice, so it helps to think about the effects of joint vs. different credit accounts. Signing up with credit accounts may enable easier monetary communication for married couples. Furthermore, signing up with charge account might assist enhance the score of a partner with a lower credit report– and couples who already have strong credit scores are likely to get approved for joint loans, home loans and charge card with lower interest rates. On the other hand, signing up with charge account is not without danger. If

one partner racks up financial obligation, fails to pay or maxes out a credit card, their spouse is most likely to see an unfavorable impact on their credit too. There can also be logistical hurdles to joining charge account, like costs for extra users. As we pointed out at the start, marriage brings with it both lots of happiness and lots of questions. Deciding how to manage credit

as a couple is an important choice, however it's certainly practical to know that marriage does not straight affect your credit history. However, for both single and married individuals, it is essential to check your credit reports frequently to make sure that they are precise. If your credit reports have inaccurate information– like accounts that do not belong to you or out-of-date balances– your credit score could be taking an unneeded hit. Thankfully, you can carry out the process of credit repair to deal with getting your rating back fit. Note: The info supplied on CreditRepair.com does not, and is not intended

to, function as legal, financial or credit guidance; instead, it is for basic educational purposes only. Written by Elizabeth Whiting< img alt="Avatar photo"src= "https://www.creditrepair.com/blog/wp-content/uploads/2021/09/Elizabeth-Whiting.Headshot3_75x75.png"height="90" width ="90"/ > Elizabeth Whiting started with CreditRepair.com in the summer of 2018 as an incoming member services consultant. Recognized a number of times for

2020. As a supporter for other's success, Elizabeth promotes self-development with her internal peers though education, encouragement and support. Using her credit expertise, she has empowered numerous consumers to continue to work towards solving difficult credit scenarios and make every effort to attain a way of life of greater opportunity.View all posts by Elizabeth Whiting Find out how it works Source