* What are the cities with the highest and least expensive average credit report of 2022?

Highest typical scoring cities

Varying from retirement communities to beachfront paradises, these cities top the list with the highest typical credit scores.

The Towns, FL Typical credit history: 806 It's simple to see why this affluent retirement home boasts the highest typical credit rating by city in the nation. It boasts an average yearly earnings that's 10 percent greater than Florida's statewide average, only 4.5 percent of citizens reside in poverty and its population grew an incredible 54 percent given that the 2010 census. Furthermore, older individuals have an intrinsic advantage when it pertains to credit scores because they typically have longer credit report.

Sun City West, AZ

Typical credit history: 792

The 2nd retirement home to make the list, Sun City West is a popular location for elders wanting to enjoy sunny Arizona. It ranked as the 2nd most desirable retirement place in the nation. Mean home income and residential or commercial property worths have both grown more than 9 percent year-over-year. The financial stability and age of the average Sun City West resident are major factors that explain why the city boasts a high typical credit score.

Oro Valley, AZ

Typical credit report: 789

This southern Arizona city lies about 15 miles far from Tucson. Oro Valley has a typical yearly income that's 28 percent higher than the United States average, and 42 percent of homeowners are between the ages of 25 and 64. The mean age is 54, which is higher than Pima County's average of 38. Oro Valley's high average credit history likely pertains to its older population, high mean annual income and high property worths.

Santa Monica, CA

Average credit score: 789

Known for its natural appeal, beachfront views and traveler destinations across its iconic shoreline, Santa Monica also has residents with high typical credit rating. According to census data, the city's typical annual income is $98,300, which is about 25 percent higher than California's average. This high income most likely contributes to homeowners' high average credit report.

Laguna Woods, CA

Average credit history: 788

Called a “golf enthusiast's paradise,” Laguna Woods is home to a flourishing 55+ community. The mean age is 75.5, and the mean annual earnings is $46,449, which is about half of Orange County's average. In spite of this, the age-restricted community still boasts high residential or commercial property values in addition to its high typical credit history.

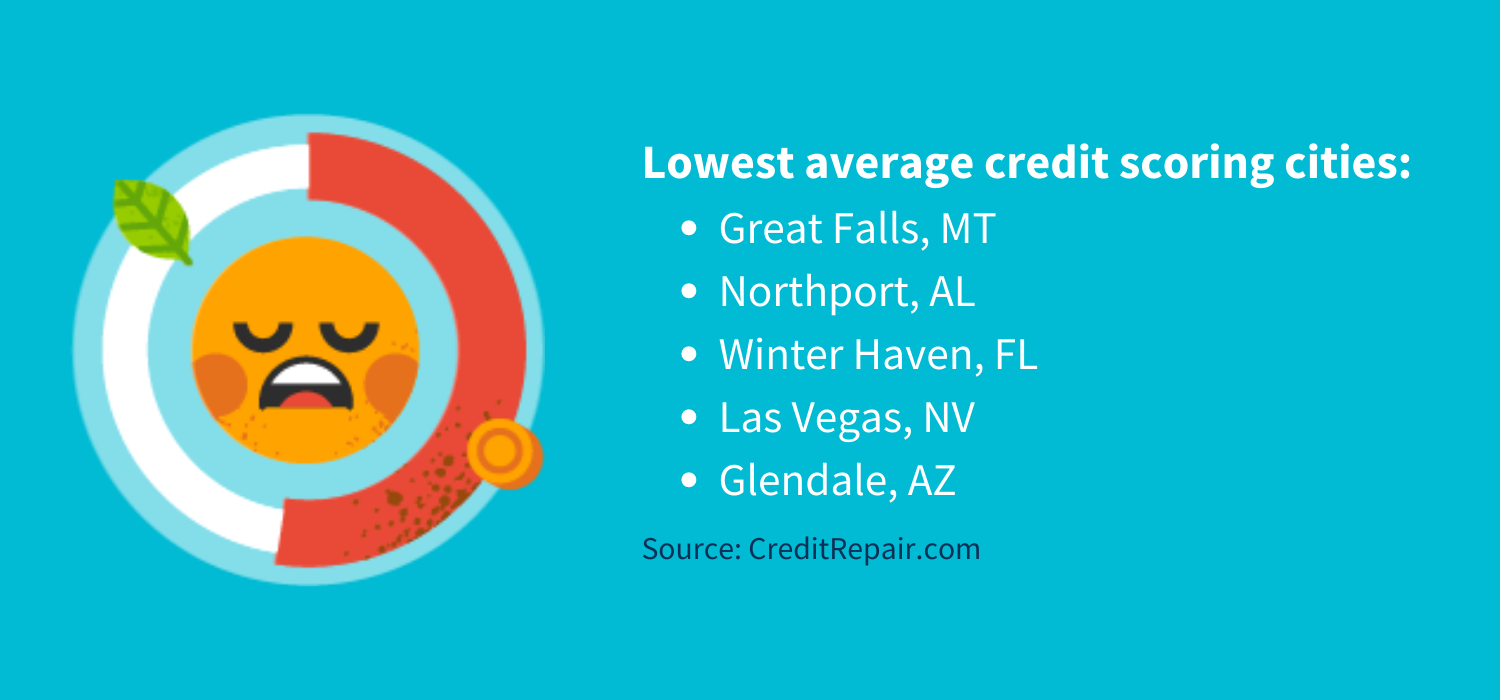

Lowest average scoring cities

On the other end of the list, we have the locations with the most affordable typical credit score by city. With scores listed below 600, the average person in these cities is considered to have poor credit, according to Experian.

Great Falls, MT Average credit report: 524 Great Falls is the third most populous city in Montana and is known as the”electrical city “due to the fact that of the five hydroelectric dams in the location. It's a popular tourist location, with visitors gathering to the city for its beautiful mountain views together with numerous museums and art exhibits.

According to the 2020 census, Great Falls likewise has a typical earnings that's well below the national average, and 14.9 percent of its population lives below the hardship line. This data might explain why the city has a low typical credit rating of 524.

Northport, AL

Typical credit rating: 524

Northport is located in Tuscaloosa county, close to the University of Alabama. This small suburban city is primarily peaceful, boasting above-average schools and ranking as one of the best places to live in Tuscaloosa County. However, 16 percent of the city's locals live listed below the hardship line. Sales tax rates and income tax rates are likewise above the national average. These aspects, in addition to the city's young population, might describe why the typical credit history is only 524.

Winter Haven, FL

Typical credit history: 524

Winter Sanctuary is located between Tampa and Orlando and draws visitors to its botanical garden, Legoland amusement park and numerous lakefront activities. Winter season Haven is a small city, with a population below 50,000— 16.7 percent of whom live below the poverty line, according to the census bureau. The mean household earnings in Winter season Haven is also below the nationwide media earnings levels This might add to the city's low typical credit report.

Las Vegas, NV

Average credit history: 524

Las Vegas is understood for extensive gambling establishments, lavish dining, and excessive glitz and glamour. But something Sin City isn't understood for is smart money management. Nevada ranks 2nd least expensive of all states when it pertains to low credit scores and ranks greatest for homeowners with the most charge card financial obligation and delinquencies.

Glendale, AZ

Average credit rating: 517

Glendale is the seventh-largest city in Arizona and ranks at the bottom of the list with a typical credit score of 517. In spite of its low credit history, Glendale is a city growing and currently growing at a rate of 0.94 percent annually, increasing percent given that the 2010 census. As the population grows and boosts the local economy, the local typical credit score might begin to increase.

What factors impact your credit rating?

A low credit rating can keep you from securing a loan or buying a home. The bright side is that the five main elements that affect your credit rating are completely within your control. With a much better understanding of what contributes to your credit report, you can make informed decisions to enhance it.

The main aspects that impact your credit rating consist of:

- Payment history

- Credit usage

- Length of credit rating

- Credit mix

- New line of credit

How to deal with your credit

If your credit history isn't where you ‘d like it to be, you can take actions to fix it. Working on your credit can appear complicated, particularly if it's been several years because you've evaluated your accounts. By following the steps below, you can repair your credit in time.

- Evaluation your report and conflict any mistakes

- Pay your costs on time

- Keep your credit utilization low

- Keep old accounts available to improve your credit age

- Open a secured charge card

- Consider consolidating your debt to make it much easier to pay off

* Note: Credit report averages are from Wallet Hub's 2022 Cities with the Highest & Lowest Credit Ratings report.

Note: The details provided on CreditRepair.com does not, and is not intended to, serve as legal, financial or credit suggestions; rather, it is for basic educational functions just.

Composed by Paul Dughi

Paul Dughi has actually been with enterprise business for more than 20 years and has an MBA in Service Administration. He is the Creator and Chief Strategist at StrongerContent.com.View all posts by Paul Dughi Discover